이 웹사이트는 제19대 대통령 임기 종료에 따라 대통령기록관이 「대통령기록물 관리에 관한 법률」에 의해 이관받아 서비스하는 대통령기록물입니다. 자료의 열람만 가능하며 수정 · 추가 · 삭제는 불가능합니다.

다만, 「개인정보보호법」에 의하여 개인의 정보를 보호받기 원하시는 분은 관련 내용(요청자, 요청내용, 연락처, 글위치)을 대통령 웹기록물 담당자(044-211-2253)에게 요청해 주시면 신속히 검토하여 조치해 드리겠습니다. 감사합니다.

SPEECHES & REMARKS

BRIEFINGS

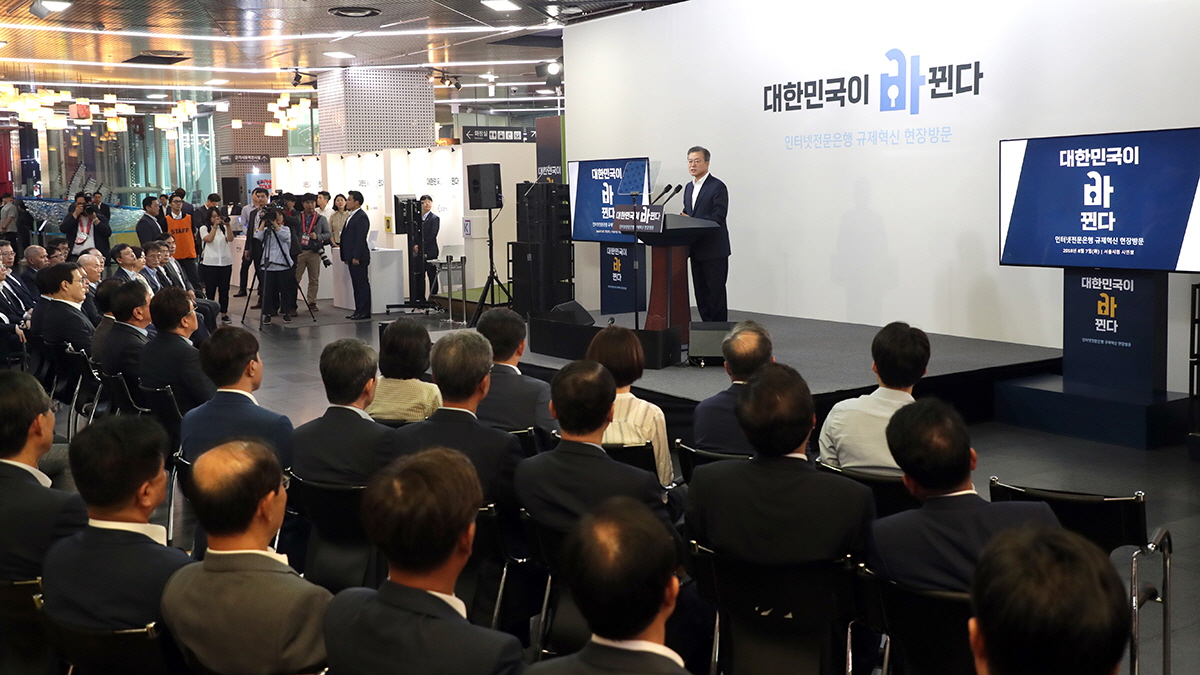

Remarks by President Moon Jae-in on Regulatory Innovation for Internet-only Banks

I am glad to meet you all. Thank you for joining us here today to discuss regulatory innovation for internet-only banks.

I just listened to presentations by business leaders and what their clients had to say about their experiences. I also heard the needs on the ground for innovating the financial sector and pioneering new industries. In addition, I could see for myself cases in which financial innovation led to financial convenience for the public.

Smartphones have now become part of our lives, going beyond a basic necessity for citizens. Things once only possible by a visit to the bank can be done anytime and anyplace with a “bank in my hand.”

Today, at this special venue for citizens, I want to share thoughts and find solutions with you on regulatory innovation for the people and the development of businesses.

In the late 19th century, the United Kingdom enforced what is now known as the Red Flag Act. It required a person to walk in front of a vehicle waving a red flag, thus reducing its speed to that of horse-drawn carriages. With steam-powered vehicles at their zenith, the country enacted this Act to protect the existing carriage trade. Consequently, the United Kingdom ended up lagging behind Germany and the United States in the automobile industry, a sector that it itself had initiated.

Systems can nurture the value of a new industry or leave it untried and withered. I have always stressed that speed and timing are everything in deregulation for innovative growth. Only timely deregulatory action will let us stay abreast of other countries and become a key leader in the era of the Fourth Industrial Revolution.

Over the past year, internet-only banks have received enthusiastic response from the people for their new financial products and services that have changed the notion of banks. They have stoked unprecedented tension and competition in the entire financial sector.

Even though virtual banks have brought a breath of fresh air, they are facing difficulties settling into the financial market. Regulatory restrictions have held them back.

One of the basic principles of Korean finance is the separation of banking and commerce. If the current system, however, tamps down growth in new industries, new approaches should be taken. While adhering to the broad principle of separating banking and commerce, we should give virtual banks more room in which to maneuver.

Innovative IT businesses exclusively should be allowed to increase their capital and technological investments in internet-only banks. Needless to say, supplementary apparatuses should also be worked out to limit who can become large shareholders and ban their transactions to prevent such an adverse effect as virtual banks becoming their private vaults.

Professionals in the financial industry,

Armed with innovative technology and capital, participation by IT businesses will give impetus to internet-only banks. They will take the primary lead in promoting technological convergence, thereby accelerating the development of new financial products and services. This will not only further expand financial convenience for the public but also help create jobs in virtual banks and—

taking it a step further —in relevant industries, including IT, R&D and the fintech sector.

The effects of deregulating internet-only banks do not stop here.

The revitalization of internet-only banks will facilitate overall competition and innovation in the financial sector.

The market structure of Korea’s financial industry has become entrenched—

with existing financial businesses at the center. Those financial companies that have already entered the market can bask in oligopolistic profits without competition and innovation. By contrast, new participants with innovative ideas face difficulties simply entering the market because of regulatory barriers.

The people desperately desire innovation in the financial industry. For internet-only banks to go beyond mere technological differentiation and lead major innovation in the Korean financial industry, they need to establish themselves as competitors who can take on the existing banking industry.

I hope that encouraging the development of virtual banks spurs innovation in the country’s entire financial industry in a direction that supports the people and industrial development and creates its own added value and jobs.

In addition, regulatory innovation for virtual banks is a policy for strong innovative growth.

Internet-only banks are a fintech industry pioneer. Fintech, a combination of finance and ICT, is transforming individual financial transactions and the financial industry landscape while simultaneously widening and deepening its connections. Services provided by virtual banks, such as banking transactions without a digital authentification certificate, around-the-clock transactions, convenient money transfers, chatbot for consultation and app-to-app payments, have all materialized through cooperation between fintech companies and internet-only banks.

When internet-only banks continue to grow and evolve as a pivotal part of the fintech ecosystem, the fintech industry can advance further. Small fintech companies can gain opportunities for growth through cooperation with virtual banks while virtual banks can upgrade their own services.

When I visited China at the end of last year, I was very surprised by how mobile payment and fintech technology had spread to even small street vendors. In fact, the European Union, Japan and China are giving a boost to internet-only banks led by innovative companies in a bid to get ahead in the competitive fintech industry.

It is my hope that regulatory reform this time can serve as an opportunity to reaffirm the Government’s commitment to developing the fintech industry into a growth engine in the era of the Fourth Industrial Revolution.

Joining us here today are the chairman and members of the National Policy Committee of the National Assembly as well as other lawmakers who have special interest in the issue.

Regulatory innovation for virtual banks is part of the process to allow innovation while firmly abiding by the basic principle of separation between banking and commerce. This will be a new example of innovation in regulatory methodology.

The Government believes that regulatory innovation for internet-only banks will be like opening a reservoir for parched fields. Deregulation of virtual banks will lead to innovative growth in the financial sector and new industries, which will again set a new course for Korea’s economic growth.

I hope that the Administration and the National Assembly will open the new path together. I expect the National Assembly to take the initiative in supporting this through legislation. I also would like to see necessary complementary measures considered.

In addition, I ask the National Assembly to quickly deliberate and pass a number of financial innovation-related bills, including the Special Act on Support for Financial Innovation.

The role of financial supervisory institutions is also very important. Only when many institutions in the financial sector and financial companies closely and harmoniously cooperate can financial innovation succeed. I ask financial supervisory institutions to press forward with financial innovation and efforts to promote competition while fulfilling their own roles so that the financial sector is not trapped in the status quo and outdated practices. They should continuously communicate with the financial sector and identify ways to innovate it.

The Government will work harder to ensure that the Korean financial industry innovates successfully and catches up with the world and, through the development of virtual banks, the fintech industry can not only add convenience to people’s everyday life but also become our newest growth engine.

I hope that the people will also stand behind the Government’s regulatory innovation.

Thank you very much.